Key Indicators for Trading Bank Nifty

Trading Bank Nifty is an index fund tracking the performance of all major banking stocks in India. This serves as an exciting earning opportunity for traders. However, to make informed trades, you need to learn to utilize the potential indicators. They can help you gain valuable insights into the trading market.

In this blog, we’ve mentioned four key indicators for trading bank nifty that can help you forecast. Let’s begin!

What are the Indicators for Trading Bank Nifty?

Here, we’ve mentioned four key indicators for trading Bank Nifty.

1. Technical Indicators

One of the most practical and result-driven indicators is technical indicators. They measure trades based on their historical price, volume, and open interest data to anticipate future market movements.

There are certain specialized indicators that work very well for Bank Nifty. Listed below are three major indicators that you will find on platforms like TradingView.

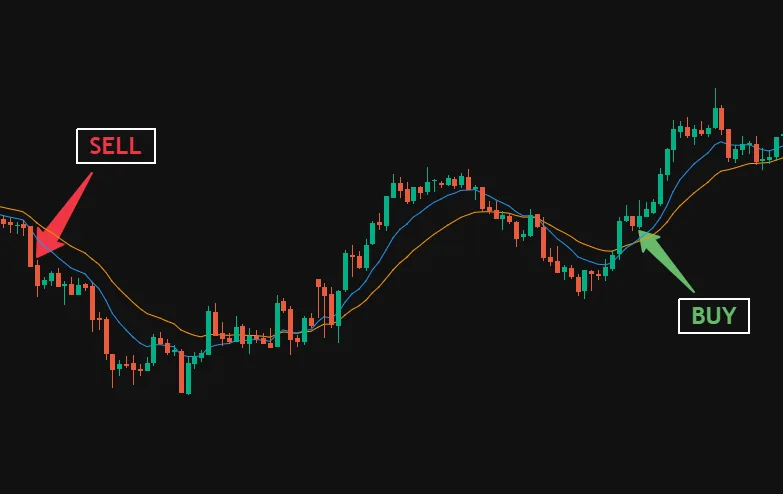

- Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA) are mainly used for Bank Nifty, enabling traders to read price data and identify the direction of the trend.

- Relative Strength Index: The RSI index is used to measure the speed and change of price movement. It provides a score ranging from 0 to 100. A score above 70 showcases overbought market conditions, while a score below 30 indicates oversold conditions. These conditions allow traders to understand potential reversal points in the market trends.

- Bollinger Bands: This indicator consists of a middle band and two outer bands. When the price of Bank Nifty goes above the upper band, it indicates overbought conditions. However, if it goes below the lower band, it indicates an oversold condition. Hence, these bands help determine volatility and potential breakouts.

You can use the above indicators to trade the Bank Nifty Index today.

2. Volume Indicator

Volume indicator showcases the number of shares or contracts traded in a specific period. It enables you to gain insights into the strengths or weaknesses of a price movement.

High trading volume accompanying price increases indicates a strong buying signal. On the other hand, price increases with low volume may indicate a lack of conviction.

For instance, the On-Balance Volume (OBV) indicator uses price date and volume to determine whether money flows into or out of the Bank Nifty.

Analyzing volume trends can drastically increase your chances of making the right trades by enabling you to avoid false signals.

3. Market Sentiment Indicators

As the name suggests, the Market Sentiment Indicator is used to understand the overall mood of market participants that may influence price action.

You may gauge market sentiments through various methods, such as surveys, news, and Volatility Index (VIX). Traders generally prefer to use volatility indexes to understand market fear and complacency.

When the value of the VIX increases, it showcases increased fear in the market, which signals the potential downward pressure on the index. In contrast, when the value of VIX decreases, the market generally tends to be in a bullish outlook.

Using market sentiment may allow traders to align their strategies with emerging market dynamics and make informed trades.

4. Price Actions and Patterns

In Price Action Trading, you have to analyze historical price movements without solely relying on indicators.

You need to look for certain specified patterns, including candlestick formations, support and resistance levels, and trendlines.

For example, forming a bullish engulfing pattern may help you determine potential reversals. Moreover, a break above a significant resistance level may suggest the continuation of an uptrend.

Recognizing these patterns can help you make timely decisions as per real-time market behavior rather. Hence, it is a more practical and reliable indicator.

Conclusion

In summary, understanding and effectively utilizing these key indicators can help you drive better results when trading Bank Nifty. We hope this blog helps you determine the most effective indicators for trading.